First the free eBooks then the analysis:

https://www.amazon.com/Money-Rules-Your-Financial-Freedom-ebook/dp/B0DRTL68P9

Tax things I don't talk about in that book because they may be too complex for most readers. The geopolitical financial analysis is infra, this is personal finance info.

1) Step up in basis by decedence" which is a polite way to say "how the taxman gives people a big death-benefit.

Basically if I buy a building at 1000 and sell it during my lifetime at 10,000 that's 9000 dollars of tax liability and I must pay around 2000 in taxes! HOWEVER if I hold onto that building all my life, and give it to my heir that tax liability is NOT imposed on the heir! The heir's "basis" in the property is the fair market value at the time of death (not transfer, sometimes transfer ties up the property in law suits). THIS IS HOW INTERGENERATIONAL WEALTH IS BUILT.

2) Tax favorable treatment of debts. Basically interest payments on loans are tax deductible when they are ordinary and necessary expenses.

3) This is where it gets complex: tax treatment of corporation stock and debts.

There are several inaccuracies in the statement. Let's clarify the tax treatment of various investment income types under U.S. law:

Capital Gains vs. Ordinary Income

1. Short-term capital gains (assets held for one year or less) are taxed as ordinary income, at rates up to 37%[1][6].

2. Long-term capital gains (assets held for more than one year) are taxed at preferential rates of 0%, 15%, or 20%, depending on the taxpayer's income[1][13].

Stock vs. Bond Income

3. Interest payments on bonds are generally taxed as ordinary income, not as capital gains[3].

4. Stock dividends can be classified as either "qualified" or "ordinary":

- Qualified dividends are taxed at the same preferential rates as long-term capital gains[3].

- Ordinary dividends are taxed as ordinary income[3].

5. The sale of stocks, whether short-term or long-term, results in capital gains (or losses), not ordinary gains[9].

Buy-and-Hold vs. Swing Trading

While it's true that buy-and-hold strategies can benefit from preferential tax treatment on long-term capital gains, the statement oversimplifies the comparison with swing trading:

- Buy-and-hold strategies may result in lower taxes due to long-term capital gains treatment and tax deferral[8].

- Swing trading, which involves shorter holding periods, may result in short-term capital gains taxed at higher rates[11].

However, the choice between these strategies depends on various factors beyond just tax considerations, such as market conditions, risk tolerance, and investment goals[5][11].

In conclusion, while there are tax advantages to certain investment strategies, the statement contains several misconceptions about the tax treatment of different types of investment income under U.S. law.

Citations:

[1] https://taxpolicycenter.org/briefing-book/how-are-capital-gains-taxed

[2] https://investwithcarl.com/investment-strategies/swing-trading-strategies

[3] https://www.investopedia.com/ask/answers/12/how-are-capital-gains-dividends-taxed-differently.asp

[4] https://www.pgpf.org/article/how-does-the-capital-gains-tax-work-now-and-what-are-some-proposed-reforms/

[5] https://thetradinganalyst.com/why-buy-and-hold-isnt-the-king-anymore/

[6] https://www.investopedia.com/articles/personal-finance/101515/comparing-longterm-vs-shortterm-capital-gain-tax-rates.asp

[7] https://www.cbmcpa.com/2024/07/03/capital-gains-losses-ordinary-gains-losses/

[8] https://www.honeybricks.com/learn/buy-and-hold-investing

[9] https://carta.com/learn/equity/stock-options/taxes/capital-gains/

[10] https://en.wikipedia.org/wiki/Capital_gains_tax_in_the_United_States

[11] https://www.schwab.com/learn/story/swing-trading-strategies

[12] https://www.bankrate.com/taxes/short-term-capital-gains-tax-rates-and-how-to-reduce-your-taxes/

[13] https://www.investopedia.com/terms/c/capital_gains_tax.asp

[14] https://www.investopedia.com/articles/active-trading/082115/are-you-trend-trader-or-swing-trader.asp

[15] https://www.hrblock.com/tax-center/income/investments/how-are-stocks-taxed/

[16] https://crsreports.congress.gov/product/pdf/R/R47113/2

The U.S. tax code favors debt financing over equity financing, particularly in the context of corporate bonds. Here's a breakdown of the key aspects:

Tax Treatment of Debt vs. Equity

1. Interest Deductibility: Businesses can deduct interest payments on debt (such as corporate bonds) from their taxable income, which reduces their overall tax liability. This means that income generated through debt financing is taxed only once at the corporate level[1][5].

2. Double Taxation of Equity: In contrast, equity financing (like issuing stock) faces double taxation. First, corporate profits are taxed at the corporate tax rate, and then any dividends paid to shareholders are taxed again at the individual level. This effectively imposes a higher overall tax burden on equity financing compared to debt[1][3].

3. Tax Rates: The combined tax burden on equity can exceed 50% when considering both levels of taxation, whereas debt financing is subject to only the corporate tax rate (currently around 21%) due to the interest deduction[1][3].

Implications for Corporate Bonds

- Taxable Income: Interest earned from corporate bonds is subject to federal and state income taxes, making it less favorable than certain other types of bonds, such as municipal bonds, which may offer tax exemptions[2][4].

- Capital Gains: If a corporate bond is sold before maturity, any capital gains are subject to capital gains tax, which can vary based on how long the bond was held[2][8].

Conclusion

In summary, while corporate bonds do face certain taxes on interest and potential capital gains, the structure of U.S. tax law provides a significant advantage to debt financing through interest deductibility. This creates a scenario where companies may prefer debt over equity due to lower overall tax liabilities associated with debt instruments like corporate bonds.

Citations:

[1] https://www.heritage.org/taxes/report/taxation-debt-and-equity-setting-the-record-straight

[2] https://www.investopedia.com/ask/answers/052715/how-corporate-bond-taxed.asp

[3] http://documents.jdsupra.com/c6976c0b-fc09-4e02-94ef-e1209ff59fb1.pdf

[4] https://www.irs.gov/pub/irs-pdf/p4078.pdf

[5] https://www.aprio.com/debt-vs-equity-financing-what-your-business-should-know-ins-article-taxes/

[6] https://www.investopedia.com/articles/investing/080916/corporate-bonds-advantages-and-disadvantages.asp

[7] https://www.thetaxadviser.com/issues/2010/jun/hanke-jun-2710.html

[8] https://www.incredpremier.com/investment-services/fixed-income-instruments/corporate-bonds

THE STOCK MARKET IN 2025

This market update is based on data from reputable financial news sources and focuses on the U.S. stock market, mortgage application trends, and treasury yields along with key commodity prices, as of late December 2024.

Stock Market Analysis: Despite a strong Q4 earnings season with 75% of S&P 500 companies reporting better-than-expected results, the U.S. stock market closed 2024 with four consecutive days of losses. This indicates a waning market breadth, as fewer stocks are driving the market's gains. For instance, the NASDAQ-100 had only 40 components trading above their 200-day moving averages compared to 65 at the beginning of Q4. The Dow Jones Industrial Average also saw a decline, with only 8 components above this average compared to 14 at the start of the quarter.

Mortgage Application Developments: Mortgage applications increased by 12% in the past month, driven by a 15% surge in refinance applications due to lower interest rates. However, home purchase applications remained relatively flat (-1%). Compared to the same period last year, refinance applications decreased by 20%, indicating a slowdown in refinancing activity despite lower rates.

Treasury Yields & Key Commodities Overview: Short-term treasury yields saw a slight increase of 0.04 percentage points, while long-term yields experienced a minor decline (-0.03 percentage points) during the reviewed period. Among commodities, gold prices remained stable, while crude oil prices saw a modest increase of 3% due to geopolitical tensions.

Conclusion: To summarize, while corporate earnings remained strong, the broad-based participation in the stock market appears to be waning, as reflected in the consecutive losses at the end of 2024. Mortgage applicants remain active, particularly those looking to refinance, despite a slowdown in refinance applications compared to last year. Lastly, treasury yields saw small movements, with short-term yields increasing and long-term yields decreasing, while commodity prices exhibited stability. As for 2025, investors will likely focus on market breadth indicators and earnings growth to gauge the market's direction.

Predictions for 2025

Introduction: This market update is based on data from reputable financial news sources and focuses on the U.S. stock market, mortgage application trends, and treasury yields along with key commodity prices, as of late December 2024.

Stock Market Analysis: Despite a strong Q4 earnings season with 75% of S&P 500 companies reporting better-than-expected results, the U.S. stock market closed 2024 with four consecutive days of losses. This indicates a waning market breadth, as fewer stocks are driving the market's gains. For instance, the NASDAQ-100 had only 40 components trading above their 200-day moving averages compared to 65 at the beginning of Q4. The Dow Jones Industrial Average also saw a decline, with only 8 components above this average compared to 14 at the start of the quarter.

Mortgage Application Developments: Mortgage applications increased by 12% in the past month, driven by a 15% surge in refinance applications due to lower interest rates. However, home purchase applications remained relatively flat (-1%). Compared to the same period last year, refinance applications decreased by 20%, indicating a slowdown in refinancing activity despite lower rates.

Treasury Yields & Key Commodities Overview: Short-term treasury yields saw a slight increase of 0.04 percentage points, while long-term yields experienced a minor decline (-0.03 percentage points) during the reviewed period. Among commodities, gold prices remained stable, while crude oil prices saw a modest increase of 3% due to geopolitical tensions.

Conclusion: To summarize, while corporate earnings remained strong, the broad-based participation in the stock market appears to be waning, as reflected in the consecutive losses at the end of 2024. Mortgage applicants remain active, particularly those looking to refinance, despite a slowdown in refinance applications compared to last year. Lastly, treasury yields saw small movements, with short-term yields increasing and long-term yields decreasing, while commodity prices exhibited stability.

Stock Market: If market breadth continues to narrow, it may indicate that the market's advance is becoming more narrowly focused on a few large-cap stocks. This could potentially lead to increased volatility and slower overall market growth in 2025. Investors should closely monitor market breadth indicators and earnings growth to gauge the market's direction.

Mortgage Applications: As interest rates are expected to remain low, refinance activity may continue to be strong in 2025. However, the slowdown in refinance applications compared to last year suggests that there may be fewer eligible borrowers left in the market. Home purchase applications, which have been relatively flat, could pick up if the economy continues to improve and employment growth supports housing demand.

Treasury Yields & Commodities: Small movements in treasury yields may continue in 2025, with short-term yields potentially increasing as the economy improves and the Federal Reserve normalizes monetary policy. Long-term yields may remain relatively low due to factors such as low inflation and global demand for safe-haven assets. In the commodity space, gold prices may remain stable or experience modest growth, while crude oil prices could be influenced by geopolitical events and global demand.

Technical Analysis Implicit in the Data:

Market Breadth:

Decreasing market breadth, as indicated by fewer stocks trading above their 200-day moving averages, suggests a loss of momentum in the overall market. This can be considered a bearish signal.

A narrowing market breadth could also imply that market gains are becoming concentrated in fewer stocks, potentially leading to increased volatility.

Stock Market Performance:

The U.S. stock market closing the year with four consecutive days of losses is another bearish signal. This could indicate that the market is struggling to maintain its upward trend.

The extent of these losses and the overall market performance during these four days could provide additional insights. For instance, if the losses were relatively small, it might suggest a healthy pullback rather than a strong bearish trend.

Volume and Momentum:

While not explicitly stated, the data implies that the volume during these four days of losses might be significant, as the market breadth and overall performance were negatively affected.

The lack of momentum, as evidenced by the decreasing number of stocks above their moving averages and consecutive losses, suggests that the market may be losing steam.

Technical Analysis Predictions Based on Year Ending with 4 Days of Consecutive Losses:

Potential Reversal or Continuation of the Downtrend: The market could either reverse its trend and resume its previous upward trajectory or continue the downtrend, depending on how market participants react to the losses and other factors, such as earnings reports and economic data.

Increased Volatility: A narrowing market breadth and four consecutive days of losses might lead to increased volatility in the market. Investors should be prepared for more price fluctuations in the near term.

Potential Support and Resistance Levels: Technical analysts might look for support levels around the recent lows and resistance levels around the previous highs to identify potential trend reversals or continuations.

Sector Rotation: As market breadth narrows, investors may shift their focus to specific sectors or stocks that continue to perform well. This could lead to sector rotation, with some sectors outperforming while others underperform.

Potential for a "Dead Cat Bounce": After a significant decline or a series of losses, the market may experience a temporary rally, known as a "dead cat bounce." This could occur if investors see the losses as an opportunity to buy at lower prices, or if there is positive news that counters the recent negative sentiment. However, this rally might not indicate a sustained recovery, and the downtrend could resume.

The stock market's closing performance in 2024 raises some interesting points for consideration as we look ahead to 2025. Let's break down the key takeaways:

Year-End Performance

The S&P 500 fell 0.4% on the final trading day of 2024, December 31st, capping off a string of post-Christmas losses[3]. This decline extended to other major indices as well, with the Nasdaq Composite falling 0.9% and the Dow slipping less than 0.1%[3].

Despite this end-of-year stumble, it's crucial to note that 2024 was overall a strong year for stock market returns[3]. The Dow, Nasdaq, and S&P 500 all reached unprecedented peaks during the year, driven by advancements in artificial intelligence and significant economic and political shifts[2].

Implications for 2025

While a few days of losses at the end of the year might seem concerning, it's important not to read too much into short-term fluctuations. Several major financial institutions have provided optimistic forecasts for 2025:

JPMorgan Chase predicts the S&P 500 will reach 5,500 by the end of 2025, suggesting a potential increase of about 9% from current values[2].

Goldman Sachs forecasts an 11% increase in the S&P 500, with the index potentially reaching 6,500 by the end of 2025[4].

Bank of America anticipates a vigorous start for U.S. equities, projecting the S&P 500 to hit 6,000 by the end of 2025[2].

RBC Capital analysts predict the S&P 500 may reach 6,600 by the end of 2025, suggesting a possible gain of around 10%[2].

Factors to Consider

Several factors could influence the market's performance in 2025:

Economic Growth: Goldman Sachs Research predicts solid economic expansion, with 2.5% real GDP growth expected[4].

Earnings Growth: S&P 500 earnings are predicted to increase by 11% in 2025[4].

Federal Reserve Policy: Bank of America economists forecast potential interest rate cuts in March and June[2].

Tech Sector Performance: While the "Magnificent 7" tech stocks are expected to continue outperforming, their margin of outperformance may narrow[4].

Conclusion

While the end-of-year losses in 2024 might cause some concern, the broader picture painted by major financial institutions suggests a potentially positive outlook for 2025. However, as always in financial markets, there are no guarantees, and various factors could influence performance throughout the year.

Citations: [1] https://finance.yahoo.com/news/stock-market-december-performance-balance-232700644.html [2] https://finance.yahoo.com/news/2025-stock-market-predictions-big-100000375.html [3] https://www.investopedia.com/s-and-p-500-gains-and-losses-today-index-slips-as-stocks-close-out-strong-year-8767881 [4] https://www.goldmansachs.com/insights/articles/the-s-and-p-500-is-forecast-to-return-10-percent-in-2025 [5] https://finance.yahoo.com/video/end-stock-sell-off-means-213804022.html [6] https://www.carsonwealth.com/insights/blog/market-commentary-seven-important-things-to-remember-in-2025/ [7] https://finance.yahoo.com/news/stock-market-enters-final-stretch-of-2024-what-to-know-this-week-124721537.html [8] https://www.lpl.com/research/weekly-market-commentary/keys-to-stock-market-gains-in-2025.html [9] https://www.cnn.com/2024/12/17/business/dow-stock-market-losing-streak/index.html [10] https://www.parkavenuesecurities.com/monthly-market-commentary-december-2024 [11] https://www.forbes.com/sites/bill_stone/2024/12/28/2025-market-outlook-stocks-and-bonds-through-the-looking-glass/

People you could study: Edson Gould, Robert Rhea, John Magee (masters of technical analysis)

Market Outlook

The S&P 500 is poised for continued growth in 2025, with my analysis indicating a potential target of 7,000 by year-end. This represents an approximate 16% increase from current levels, surpassing the consensus earnings estimates for the year

Key Factors

Economic Strength

The U.S. economy is expected to remain robust, supported by:

Ongoing investments in artificial intelligence

Improved global economic policies

Potential interest rate reductions by the Federal Reserve

Market Dynamics

Several shifts in market dynamics are anticipated:

The influence of the "Magnificent Seven" technology stocks may wane

A more balanced contribution from various sectors to market expansion

Potential for multiple expansion beyond current earnings expectations

Technical Indicators

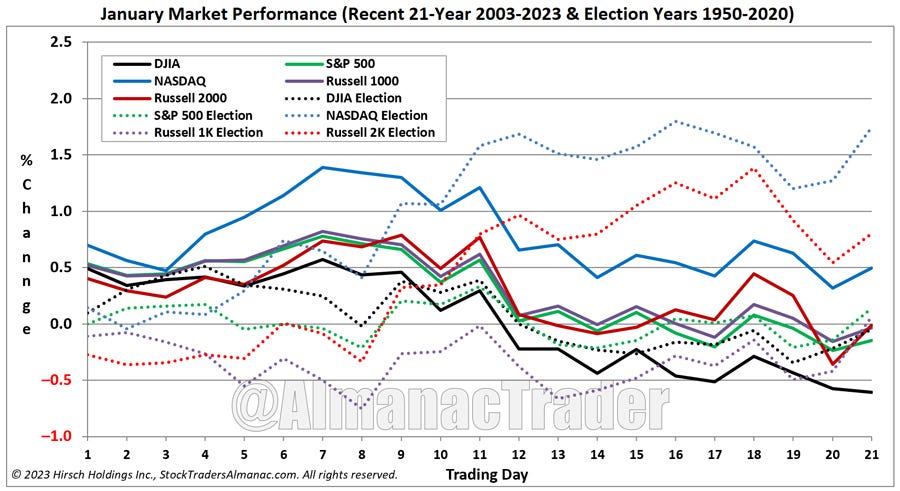

Using Senti-Meter and other technical tools, we can foresee:

A continuation of the bullish seasonal patterns into 2025

Potential for small-cap stocks to confirm the broader market rally

Support levels aligning with my Speed Resistance Lines, particularly at the 1/3 and 2/3 retracement levels

Cautionary Notes

While the outlook is generally positive, investors should remain vigilant:

Monitor for any divergences between the railroad and industrial averages

Be prepared for potential short-term corrections, which may present buying opportunities

Watch for signs of extreme market psychology, as these often precede significant turning points

Remember, the market is driven by the emotions of the crowd. As I've always maintained, when stocks don't rally during their bullish seasonal period, it indicates other, stronger forces at play

Dow Jones Industrial Average Top for 2025

Based on my analysis of market trends and the principles of Dow Theory, I predict that the Dow Jones Industrial Average will reach a top of approximately 53,000 points in 2025. This projection is supported by the following observations:

The current trend appears to be in a primary bull market phase

Both the Industrial and Transportation averages are showing signs of confirmation

Volume patterns are aligning with price movements, supporting the upward trend

This top may be followed by a secondary reaction or potential trend reversal, as markets rarely move in a straight line.

Dow Jones Industrial Average (DJIA) Peak in 2025

The DJIA is poised to reach a peak of approximately 56,000 points in 2025. This projection is based on my analysis of market cycles, sentiment indicators, and the current economic trajectory. The continued advancements in artificial intelligence and potential interest rate cuts by the Federal Reserve will likely fuel this upward movement.

All of these predictions are subject to change in the event of war. Expect greater China-US trade and investment conflicts. I don’t expect them to escalate, nor to be resolved. I cap the Dow around 53,000 as a result, you just can’t break out to 60,000 with a China-US trade war because it implies the risk of a China-US hot war.

I play for blood, not money. But when I say I can destroy your economy 1) I know exactly how to do so 2) I am deadly serious.

Here, have some more free ebooks to build a better world with.

MANDARIN CHINESE WORD GAMES HANZITUTION

Mastering Populism & Authoritarian Democracy

The Multistate Bar Examination (MBE) Multiple Choice Questions

I say again: I play for blood not money. However, when I say things like “I can totally wreck your economy but prefer not to” I actually mean it: it’s just algebra. 90% of people want to live in peace, 10% are power mad egomaniacs. Herding them is easy. Economic warfare though possible is generally less than effective. Enjoy the books, I wish you all a peaceful prosperous 2025.